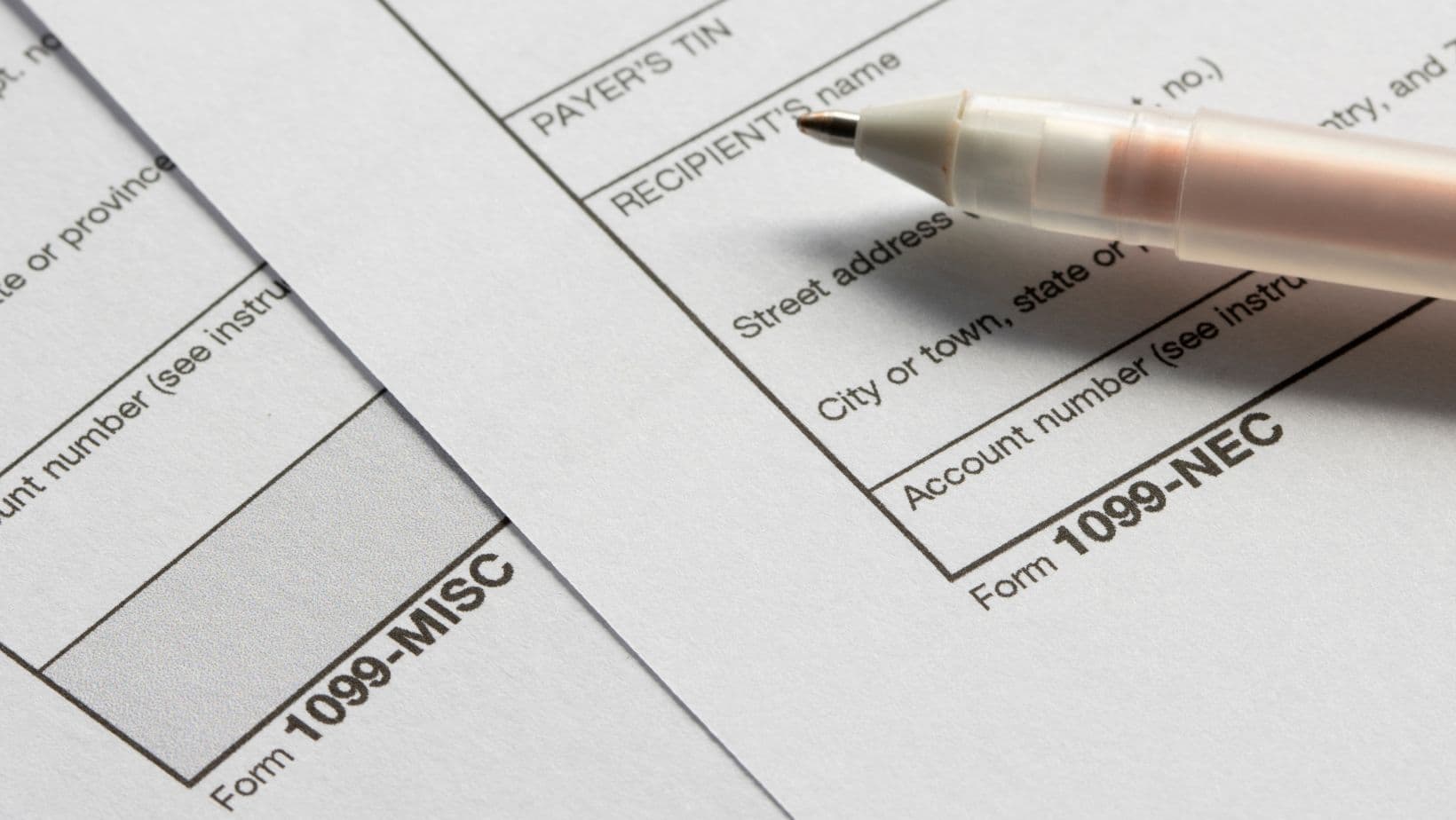

1099 Changes: What You Need to Know

Classifying workers correctly is more than just a box to check—it’s your shield against legal, financial, and reputational risks. With multiple federal and state laws to follow, it can be a challenge to ensure you are in compliance with the most current requirements and protecting your company. Does your company hire independent contractors? If yes, then read on!

Recently, the U.S. Department of Labor (DOL) published the Final Rule on analyzing who is an employee or independent contractor (IC) under the Federal Fair Labor Standards Act (FLSA). The updated ruling includes a six-factor multifactor “economic reality” test. This test does not weigh any factor more than another, nor does it require that all be true to classify the worker as an independent contractor. They are assessing the worker by the following criteria and we’ve included some questions (albeit not exclusive) to consider in italics:

1. Opportunity for profit or loss depending on managerial skill

- Do your ICs set or negotiate their rates and work on their own schedule?

2. Investments by the worker and the potential employer

- Do your ICs invest their time and money on marketing efforts to promote their services and attract clients?

- Do they spend money on capital or entrepreneurial improvements that support an independent business and serve a business-like function, such as increasing their ability to do different types of or more work, to reduce their costs, or to extend their market reach?

- Heads up! Costs paid by an IC for specific tools and equipment to perform a specific job do not count in this regard. Costs paid by the worker should be compared to the costs of the employer to ensure the IC is making similar types of investments that show they are operating an independent business.

3. Degree of permanence of the work relationship

- Once your ICs complete a project, is there no expectation for ongoing or permanent work?

4. Nature and degree of control

- Do your ICs decide where and when to work, as long as they meet the agreed-upon deadlines and deliver high-quality work according to their contract?

5. Extent to which the work performed is an integral part of the potential employer’s business

- Is your IC’s work not critical or necessary to the company’s primary ability to deliver its services and generate revenue?

6. Skill and initiative

- Do your ICs develop strategies tailored to your company’s needs and take the initiative to track the performance and make adjustments to maximize results?

The more “Yes” answers you have to the questions above, the more favorable it will be to classify the worker as an independent contractor.

In addition to these six items, the DOL stated that additional factors may be taken into consideration if the worker is in business for themself (independent contractor), as opposed to being economically dependent on the company for work (Employee).

Well, I only have employees in California. Does this apply to me?

As of January 2020, employers in California must follow the “ABC Test” in determining whether an individual is an independent contractor or an employee unless the position qualifies for an exception. Under the ABC Test, a worker is considered an employee and not an independent contractor, unless the worker satisfies all three of the following conditions:

- A: The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact; AND

- B: The worker performs work that is outside the usual course of the hiring entity’s business; AND

- C: The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

If a position in California qualifies for an exception from the ABC Test (there are quite a few here), the amount of control the company has over the worker will be a big factor that determines if they can be an IC.

What do I need to do now and why?

- All employers nationwide should do their due diligence in reassessing any workers classified as independent contractors under the new guidance no later than March 11, 2024, when the DOL’s Final Rule goes into effect.

- In most cases, if a worker is not an independent contractor under California’s ABC test, they will also not be under the DOL’s Final Rule. However, we recommend ensuring workers in California meet both Federal and State guidelines. Companies must ensure they are meeting whichever standard provides workers with the greatest protection to workers.

- It’s not just California – other states are also adopting independent contractor “tests” similar to the ABC Test.

Penalties for Misclassifying Employees as Independent Contractors

Companies should be careful about misclassifying employees as independent contractors as that can lead to various penalties and consequences, which can be severe and may result in significant financial and legal consequences for employers. Misclassifying employees as independent contractors can lead to various penalties and consequences, including:

- Tax Penalties: Employers may be required to pay back taxes (income taxes, Social Security taxes, and Medicare taxes) and penalties

- Unemployment Insurance Penalties: Employers may be liable for back payments and penalties

- Workers’ Compensation Penalties: Employers may be required to cover medical expenses and lost wages for misclassified workers who are injured on the job, even if they were not previously covered by workers’ compensation insurance

- Wage and Hour Violations: Employers may be liable for back wages, liquidated damages, and penalties for violating minimum wage, overtime, and other required benefits

- Civil Penalties and Lawsuits: Misclassified workers may file lawsuits seeking unpaid wages, benefits, and damages for labor law violations.

- Regulatory Enforcement: IRS and Federal/State Labor agencies may conduct audits and investigations to identify misclassification violations and impose fines and penalties

If you find that you have misclassified a worker as an independent contractor, there are steps you should take to remedy the situation as soon as possible. These steps will depend on the situation and how long the misclassification has been occurring.

Reach out to SDHR Consulting to engage an experienced HR Professional who can assist you with remedying the situation and ensure you are in compliance with independent contractor classification requirements in the future.

Author: Laura Miller, HR Consultant